05 April 2017

The transition in Central and Eastern Europe has been underway for more than a quarter century. The development of civil society is a substantial part of this transition and plays a key role in responding to major societal challenges. More civic actors mean not only more opportunities for a wider range of disadvantaged groups to have their “voices” heard, but can also help create stable and just societies and states.

Especially after 1989-1990, the civil sector did not develop as fast in post-communist Europe as had initially been expected by experts and elites. A deep mistrust of institutions and organisations combined with a disappointment regarding ongoing transformation processes was reflected in the low level of participation and volunteering in civil society organisations.

It is therefore all the more surprising and encouraging that today more than a third of all taxpayers (38.6 per cent) in the countries of the “Percentage Club” designate part of their taxes to civil society organisations. This is just one of the conclusions reached by a recent study comparing tax percentage designation in Hungary, Lithuania, Poland, Romania and the Slovak Republic. The “Assessment of the Impact of the Percentage Tax Designations: Past, Present, Future” is the outcome of a research project commissioned by ERSTE Foundation and implemented by the Centre for Philanthropy, a not-for-profit organisation in Bratislava. The research was conducted throughout 2015 and primarily focused on five countries that use this kind of tax designation system, where it has remained a popular policy instrument for over twenty years now.

What is percentage tax designation?

There are different ways for civil society and NGOs to gain financial support. There is government funding and/or private funding from domestic or foreign donors. The percentage tax designation system is a mechanism whereby state resources – or in other words certain percentages of the income tax of an individual taxpayer – are redistributed for public benefit. The source is always personal income tax.

More than a third of all taxpayers (38.6 per cent) in the countries of the “Percentage Club” designate part of their taxes to civil society organisations.

At the end of the tax year, when the individual taxpayer pays taxes to the authorities, he or she may voluntarily designate a certain percentage of income tax to a specific entity as beneficiary. First, the taxpayer needs to reflect on societal needs, or at least what he or she perceives as such. The taxpayer’s choice is accepted and not challenged by institutions. This makes the mechanism a decentralised, flexible and unbureaucratic method to donate a specific amount of money that would have been paid in any case. Slovakia’s law, in contrast to that of other countries of the “Percentage Club”, enables even corporate bodies to allocate a given percentage of taxes. The rate of the possible designation is determined by different laws. It varies from three per cent in Slovakia to one per cent in Poland.

In general, beneficiary groups can be civil society-based non-profit organisations and, in some countries, churches as well as political parties. In Romania the mechanism was introduced to create an additional source of income for either merit- or need-based scholarships and low-income students. In Lithuania, taxpayers can even allocate up to two per cent of their income tax to artists.

How did it all start?

After the so-called “otto per mille” (0.8 per cent) was established in Italy in 1985, the idea of percentage tax designation was also discussed among various stakeholders. In the early nineties, the newly evolving countries in Central and Eastern Europe began to consider introducing a similar concept to fund church and civil society.

The mechanism was first formally accepted in 1996 in Hungary. Later, other versions of the mechanism were introduced in the Slovak Republic (1999), in Lithuania (2002) and in 2003 in Romania and Poland. The financing and normalisation of the relationship between church and state has been an important question in the CEE countries that emerged from communist rule in the 1990s. It is no surprise that the financing of the church was one of the triggers that developed the tax designation mechanism in the region.

The normalisation of the relationship between church and state and its financing was one of the triggers that developed the tax designation mechanism.

Another motivation was to allocate additional financial resources to public benefit entities. The goal of the endeavour was not only to provide flexible funding for civic organisations via the percentage designation, but also to promote volunteer engagement and philanthropic culture and tradition.

The concept has also been considered, at least to some extent, by eight other post-communist countries (Croatia, Czech Republic, Estonia, Macedonia, Moldova, Serbia, Ukraine, Georgia) and is still being debated in some of them. In 2015, Moldova passed a law to install the mechanism following the Romanian example. Japan, Spain and Portugal have already introduced similar tax designation systems.

Centrum pre filantropiu

The Centre for Philanthropy (Centrum pre filantropiu) was founded in August 2002 in Bratislava as a non-profit organisation providing beneficial services. The aims are to strengthen non-governmental and non-profit organisations and their position within society, to spread values and models of giving, charity and volunteering as an expression of mutual solidarity and understanding among people as well as between public and private sectors, to support ideas of participatory democracy and to help increase the involvement of citizens in decision-making processes regarding questions of public interest. Via its activities and programmes, the Centre for Philanthropy wants to fulfil the ideals of civic society, human and citizen rights, sustainable development and respect the principles of pluralism, freedom and democracy.

The focus of the study and the motivation behind it

The study focuses on a particular type of this mechanism, with the designator being an individual and the beneficiaries for the most part being not-for-profit organisations (as opposed to other systems that benefit political parties, the church or individuals). The geographical priority lies on the five countries of the “Percentage Club” in CEE, as mentioned above, where a significant part of the percentage tax mechanism evolved and the socio-economic developments are relatively similar and comparable to one another. In addition, a part of the study deals with Italy, the first country to introduce the mechanism.

To date, twenty years after the introduction of the mechanism in Hungary and ten years after the latest and only comparative research, there is an emerging need to evaluate the mechanism in light of its original ambition. As there is a shortage of materials on the assessment of the mechanism, it was necessary to take a closer look at this phenomenon and at its role and impact as well, which could stagnate without constant evaluation and amendments. Another purpose of the study was to examine and share insights on an international level.

Conclusions

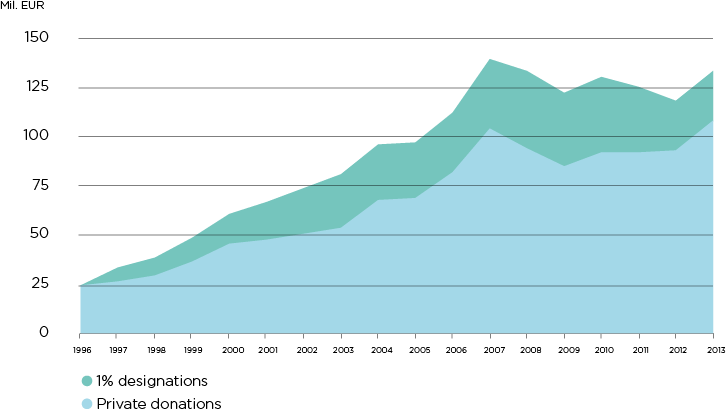

Over time, the system has grown in terms of numbers in every respect. What was once an innovative policy solution has become part of a well-established distribution system. Still, based only on the figure of two per cent of revenue in the five CEE countries that stems from percentage designation in proportion to the overall revenue of the non-profit sectors , one might have the impression that the contribution is modest. However, the system was not only able to generate and increase public funding, it has also created a specific climate of empathy and contributed to building and strengthening a culture of philanthropy. Overall, an increased understanding of the importance of civil society and solidarity has been observed. Could this be a growing trend in the countries of the study? Take Hungary, for example: on the one hand, private donations continue to be of greater importance, while on the other hand designated taxes have increased steadily since the introduction of the system (Study figure 10 – p. 35).

Study figure 10: Growth of 1% designations, individual donations in Hungary, 1996–2013

For taxpayers, participating in the scheme of tax designation is a form of civic participation that requires relatively little effort. In Romania, 41 per cent of taxpayers use the provision because it is free, 33 per cent participate because they do not want the money to go to the state budget, and 27 per cent feel attached to the mission of the beneficiary. Looking at the same question from the perspective of volunteering, there is either a stable (Poland), slightly increasing (Slovakia, Hungary), inconclusive (Lithuania), or decreasing (Romania) trend.

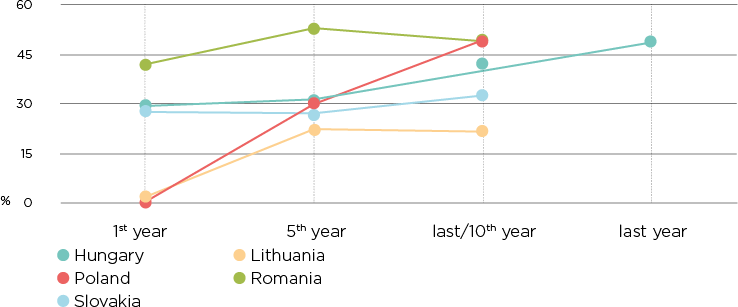

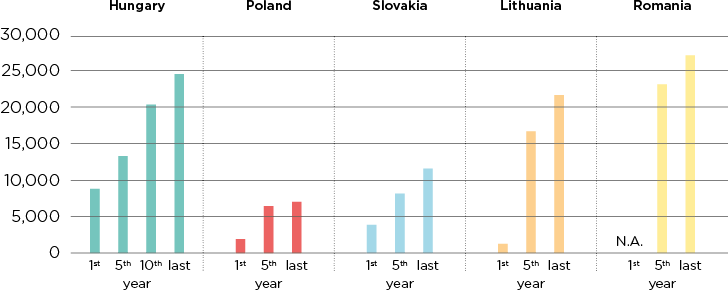

All in all, around 17 million individual taxpayers (out of 40 million individual taxpayers) make use of the designation mechanism. The ratio of designators in all five countries has grown, especially in the early years (Study figure 12 – p.52).

Study figure 12: Ratio of designators (based on Per Phil database)

While it is not the whole sector that has benefitted financially from the mechanism, it seems to have added weight to the voice of civil society at large. Thanks to the percentage mechanism, organisations have started to put more emphasis on communicating with their own members and clients, and have begun reaching out to the broader public, which has resulted in increased visibility for the NGOs. One of the most important elements of the mechanism has been its flexibility and predictability, which contributes to the stability of the third sector and channels public funds towards those recipients that would otherwise have limited access to other financial resources: Lithuania leads, with the highest proportion of designated organisations at 80 per cent, followed by Hungary at 35 per cent, Romania at 30 per cent and Slovakia at 24 per cent, while in Poland it is only 7 per cent.

One of the most important elements of the mechanism has been its flexibility and predictability, which contributes to the stability of the third sector and channels public funds towards those recipients that would otherwise have limited access to other financial resources.

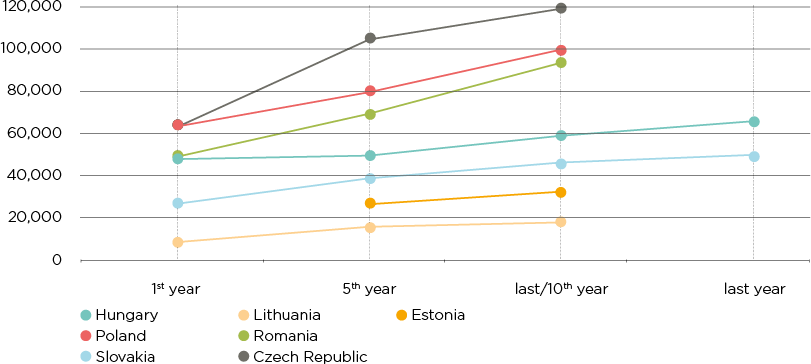

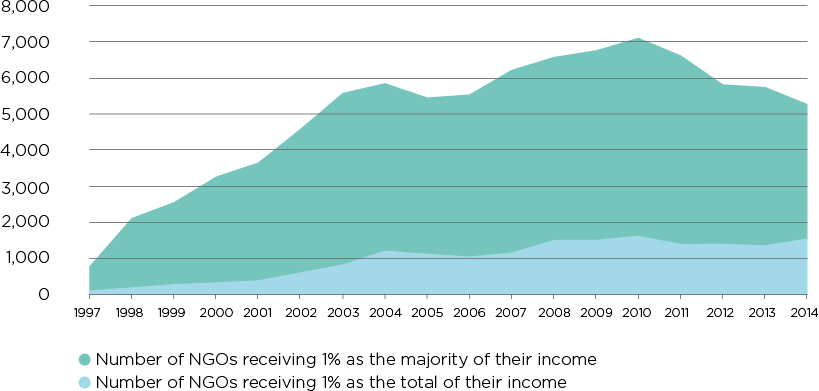

This means that in these five countries, every third organisation on average benefits from the system. In total, the percentage mechanism is estimated to be a yearly revenue source of EUR 242 million in the five CEE countries. Even though not every NGO benefits from the system, the overall number of NGOs has increased (Study figure 11 – p. 42). In Hungary, as much as 8 per cent of the non-profit sector has received the majority of its revenues from percentage designations, while for 2.4 per cent of organisations, percentage revenues were their only source of income in 2010 (Study figure 5 – p. 30).

Study figure 11: Density of non-profit organisations (number of NPOs per 1,000 inhabitants, source: Per Phil database)

Study figure 5: Number of NGOs receiving 1% in Hungary as the majority and as a total of their revenues (source: HCSO)

Categorised by the field of activity, organisations dealing with health and healthcare-related issues are the most popular in the five countries (based on reports of local researchers), followed by education and science, religion, environment, sports and tourism, and culture and arts. It has been assumed that percentage designations are not reaching pro-democracy, advocacy and civil rights-related organisations, as their missions are not appealing enough to the general public. In recent years a new trend has emerged in Hungary: non-profit organisations with an advocacy role and independent reporting have been benefiting more and more from the percentage mechanism.

Non-profit organisations with an advocacy role and independent reporting have been benefiting more and more from the percentage mechanism.

The Hungarian government temporarily removed such organisations from the list of eligible organisations for one year – a sanction that was lifted in 2007 but demonstrates the vulnerability of the mechanism and the possibility of its being influenced by political interests. Today, the percentage mechanism is unlocking its full potential as a democratic and transparent redistribution system with a continuously growing number of beneficiaries (Study figure 15 – p. 53).

Study figure 15: Number of beneficiaries of percentage regulations in five countries (based on “Per Phil database” using national data sources)

At the same time, a decrease in indirect support can be noted in the form of fewer tax advantages for private donors. The abolishment of fiscal incentives can be seen as a negative side effect of percentage designation. Slovakia completely abolished tax deductions for both individual and corporate donations. Romania is the only country where the fiscal incentives for individual donors have not changed since the enactment of the percentage system. Nevertheless, politicians often use the existence of the percentage system as an excuse for not providing additional support.

Politicians often use the existence of the percentage system as an excuse for not providing additional support.

It has proven to be true that there is a lack of systematic policy evaluation in four of the five countries examined in the study. Still, the system is not stagnating – despite the negative developments. Changes and adjustments are frequent, and the number of beneficiaries and designators has been growing since the start. With the results of this study, the authors are confident that the evolution of the system will not only continue, but will also improve and serve as an important impulse for the financial wellbeing of non-profit organisations as well as for fostering appreciation for civil society by citizens in CEE countries.

More findings can be found in this first transnational study on the topic at www.taxdesignation.org

About the study

An international team of country research associates (CRAs) from Croatia, Czech Republic, Estonia, Hungary, Italy, Lithuania, Macedonia, Romania, Serbia and Slovakia operated under the coordination of lead researchers Marianna Török and Boris Strečanský. The study shows the perspectives of both practitioners as well as researchers on the tax designation issue. The research associates were not only from tax designation countries but also from countries without the mechanism.

This research project was prepared in 2014 and conducted during 2015 in five CEE countries that use the percentage tax designation system, and where the system has remained a popular policy instrument over twenty years: Hungary, Lithuania, Poland, Romania and Slovakia. It focused on four questions: 1) What is the percentage tax designation system and what is it not? 2) What is its role in funding the non-profit sector? 3) What are its side effects? and 4) What is the connection between policy-making and the results?